Fill out Form W-9 Online in 2025

Fill out your W-9 form - fast and secure

18 760

Forms filled

2 391

Forms signed

1 327

Forms sent

Completamente Integrado Con

Get your Form W-9

![Fill out [form_name]](/_next/image?url=%2Fimages%2Ffill_1.webp&w=750&q=75)

Fill out Form W-9

Enter your personal or business information directly into the form — fast, accurate, and easy.

Sign the Form

Insert your legally-binding digital signature anywhere on the document.

Download or Share

Download your completed Form W-9 instantly or share it with others.

Where do I submit my completed W-9?

Submit your completed W-9 directly to the requesting party, not to the IRS. Double-check all information before sending to prevent complications with payments or tax reporting.

How can I digitally sign my W-9 form?

After completing all required fields, use PDF Paw's built-in signature feature to add your electronic signature. Simply click the signature tool, create your signature, and apply it to the form before downloading.

Step-by-step W-9 completion guide

1. Load the W-9 template in PDF Paw editor

2. Enter your legal name from tax records

3. Add business name if applicable

4. Choose your tax classification type

5. Input complete mailing address

6. Provide your taxpayer ID number

7. Add electronic signature

8. Download the finished document

What is the purpose of Form W-9?

Form W-9 serves to collect taxpayer identification details from service providers and contractors. It helps businesses comply with IRS reporting requirements and ensures proper documentation for tax purposes.

Where can I access a blank W-9 template?

PDF Paw provides an official IRS W-9 template pre-loaded in our editor. You can begin completing the form instantly without searching for or downloading additional files.

Who needs to complete a W-9 form?

Independent contractors, freelancers, consultants, and service providers typically complete W-9 forms when working with businesses. Any individual or entity receiving payments for services may need to provide this documentation.

What information does a W-9 collect?

The W-9 form gathers your legal name, business classification, mailing address, and taxpayer identification number. It also includes a certification section to verify your tax status and U.S. person designation.

When is W-9 submission required?

W-9 forms are requested when needed for tax reporting, typically at the start of business relationships. Submit promptly upon request to avoid delays in payment processing or contract execution.

Are there exemptions from W-9 requirements?

Some individuals may be exempt from W-9 requirements, including traditional employees (who receive W-2s instead) and certain non-U.S. persons. International contractors working outside the U.S. typically use different forms.

What users are saying about our Online Tool

Frequently Asked Questions

Related Forms

A printable blank check template is a digital form that replicates the design and layout of a standard check. This template allows users to easily fill in their own details, such as payee name, amount and memo, either manually or electronically.

A notice of intent to vacate is a letter that informs the landlord you plan on moving out of your rental property. This allows you to meet any requirements about advance notice in your lease agreement.

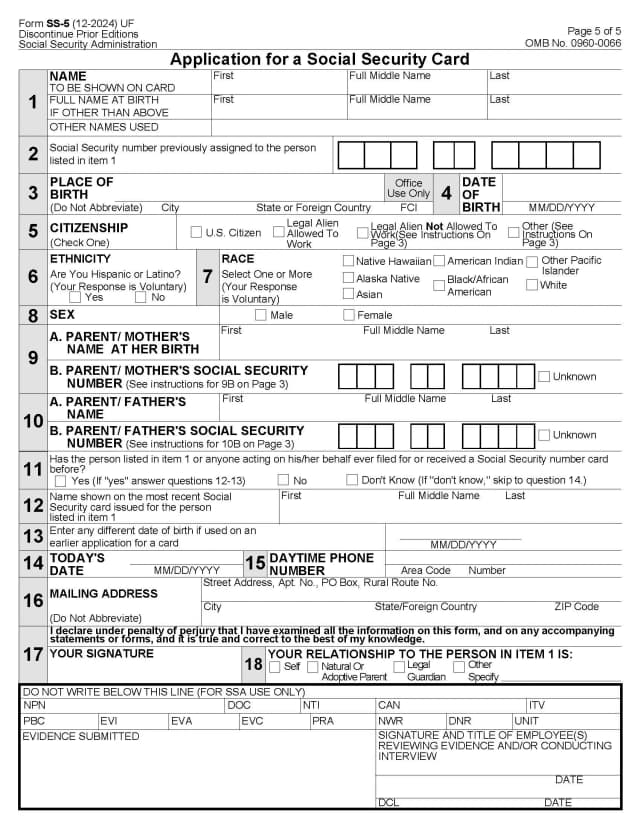

Form SS-5 is essential for applying for a new Social Security card, replacing a lost or stolen card, or updating your personal information with the Social Security Administration.